WHAT EVERY PERSON WISHING TO SELL A STRUCTURED SETTLEMENT

SELL A STRUCTURED SETTLEMENT

In this every changing financial climate a person’s financial needs or wants can change dramatically overnight both as a result of the recession, and changing financial needs, many individuals with structured settlement payment annuities have decided to sell and/or convert their structured settlement payments into a single lump sum cash payment. For many people than those who recognize this it is also a very smart decision to enter into such a transaction should the financial need to do so arise.

In this every changing financial climate a person’s financial needs or wants can change dramatically overnight both as a result of the recession, and changing financial needs, many individuals with structured settlement payment annuities have decided to sell and/or convert their structured settlement payments into a single lump sum cash payment. For many people than those who recognize this it is also a very smart decision to enter into such a transaction should the financial need to do so arise.

By now, most people have also seen the endless barrage of daily television commercials offering “cash now” claiming “it’s your money, use it when you want to”; or even the animated cartoon commercials with a dog protecting his “bone”. All paid for by companies engaged in the very lucrative business of buying an individual’s annuities, and structured settlement payments, with all commercials focused on one central theme: THAT a person can get “ALL” of “their” money almost instantly!

Although, the decision of “who” to sell to, and what the process of selling structured settlement payment annuities actually entails is both a very complex, and time-consuming process. And for the “unwary consumer”, can be a very financially “bad” decision unless one is aware of ALL the facts!

The real truth, however, is far more complicated, and despite the inferences and claims “cash now”, the actual process of selling a structured settlement:

1. Requires a Court to approve the transaction;

2. Will also take up to 90 or more days to complete the process; and

3. The final “net” amount received by a seller is far less than the “face value” of structured settlement annuity payment amounts.

Also, not all transactions are approved by a Court, and so there is no guarantee that someone wishing to sell their structured settlement payment annuities will actually get their money now!

So, just because a person wishing to sell structured settlement annuity payments believes he or she should get an even dollar for dollar exchange for their payments, they instead receive a deeply discounted amount of money for their structured settlement annuity payments (based on a complex mathematical formula that involves multiple reductions and discounting of the underlying annuity and structured settlement payments), it is critical for any person to sell their structured settlement annuity payments to be as informed as possible before making any decision to sell.

This article is designed to help any person that desires to sell their structured settlement annuity payments to obtain more financial freedom and cash liquidity BEFORE the decision to sell is made.

This article will also act as a guide to assist in determining HOW to get the MOST amount of money possible for structured settlement annuity payments. Additionally; how and which company to approach, and whether an expert or advisor/consultant should be used both in the negotiation of the initial purchase and sale, as well as in the completion of the sale process in the Court System.

First, an overview as to the process itself, its history, what is involved, and how Eugene Ahtirski http://structuredsettlementexpert.co

can help in ALL areas should further assistance be desired or required. Testify as an expert, provide an independent review of the transfer, or find comparable quotes to assist in showing the judge the validity of the deal.

State Legislation designed to protect the sellers of structured settlement annuity payments

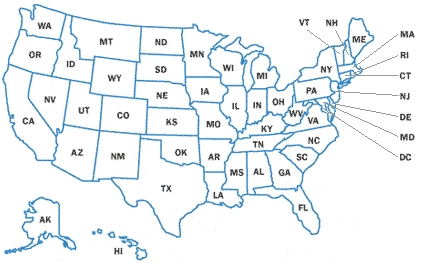

For starters, 47 of 50 states have a form of a “Structured Settlement Protection Act”. All State’s acts were created by each stat’s legislature in order to protect the “seller” of the payments from being taken advantage of by unscrupulous “purchasers”.

Specifically,

any “sale” or “transfer” of a structured settlement must not only be approved in a Court of Law, but all the “terms” of the sale (including the language in the contract) must also meet the specific requirements of the state law that governs the sale

In other words, for all residents,

the transfer must be brought pursuant to the provisions of the state in which they reside in

You can also locate the full and complete text of state statues on our resource page

http://structuredsettlementexpert.co/Resources.html

ALL STATE STATUTES MUST ALSO COMPLY WITH THE FEDERAL MODEL ACT

Separate from the state law that governs the transfer, a transfer of structured settlement annuity payments must also comply with Federal Law. Specifically, that each individual state “structured settlement protection act” is actually modeled after a “Federal Model Act”); and every transfer of a structured settlement annuity payment must meet the requirements of both the state and federal acts.

The Federal Model Act is set forth 26 U.S.C. § 5891, and the complete text of the law can be located at: http://uscode.house.gov/download/pls/26C55.txt. Enacted by the 107th Congress, first session, in 2001 as part of the Victims of Terrorism Tax Relief Act of 2001, 26 U.S.C. § 5891 requires that all transfers must be approved by a State Court where a Judge makes certain specific findings in what is called a “qualified” order.

If a transfer of structured settlement annuity payments does NOT comply with both the Federal and State Laws that govern the transfer, then the transaction will probably NOT fund; as a 40% excise tax is imposed on the purchaser of the payments making funding costs prohibitive

26 U.S.C. § 5891also contains references to other sections of the Internal revenue Code (“IRC”) as well, which specifically deal with how “other” tax issues under each and every transfer are to be both treated and avoided by the various parties to the transaction, separate from the seller of structured settlement annuity payments.

These sections (while not applicable to the current discussion) can be found at 26 U.S.C. sections 72, 104(a)(1),104(a)(2), 130, 461(h), and section 3405; all of which set forth the tax treatment and possible tax consequences related to structured settlements as applied to annuity issuers, annuity owners and obligors, and the final assignees of structured settlement annuity payments. For further reference, please see http://www.irs.gov.

THE POSSIBLE DENIAL OF A SALE OF structured settlement annuity payments by a Court

Because a Judge must APPROVE the sale of structured settlement annuity payments, a Judge can also DENY any particular transfer, UNLESS a Judge believes (at minimum) that:

1. The transfer of the structured settlement payment rights is fair and reasonable and in the best interest of the payee, taking into account the welfare and support of his or her dependents;

2. The transfer complies with the requirements of the [insert state name] statute, will does not contravene any Federal or State Statute, or the order of any court, or responsible administrative authority.

Consequently, because a Court must find that a transfer of structured settlement annuity payments is in a person’s “best interests”, ANY PERSON WISHING TO SELL THEIR structured settlement annuity payments should consult with an independent advisor both before and during the process of the sale and transfer of a structured settlement annuity.

LOCATING A STRUCTURED SETTLEMENT ADVISOR, CONSULTANT, EXPERT, AND/OR A STRUCTURED SETTLEMENT ATTORNEY TO ASSIST IN THE PROCESS

Please visit the following web links for further direction on how to obtain proper legal, financial, negotiating, and related advice on the sale of structured settlement annuity payments:

Eugene Ahtirski – http://eahtirski.com

http://structuredsettlementexpert.co

https://structuredsettlementatty.com

http://structuredsettlementadvisor.info

http://structuredsettlementcounselor.com

Comments

There are no comments yet.